Welcome to your member dashboard

Thank you for purchasing the Common Reporting Standard: Survivor's Guide to OECD Automatic Exchange of Information of Offshore Financial Account.

This section provides you with some exclusive content which is not available in the book and to others. We aim to update this regularly with information.

Latest OECD Publications

Download all the latest OECD publications here:

- Standard for Automatic Exchange of Financial Account Information - Download

- Standard for Automatic Exchange of Financial Account Information in Tax Matters: Commentary - Download

- Standard for Automatic Exchange of Financial Account Information in Tax Matters: Implementation Handbook - Download

- Update on Voluntary Disclosure Programmes: A Pathway to Tax Compliance: Download

- The OECD Guide on the Protection of Confidentiality of Information Exchanged for Tax Purposes - Download

Whats new

22 December 2015

Mauritius: Common Reporting Standard implementation is delayed

The Mauritius Revenue Authority in late December 2015 announced that the date for implementing the common reporting standard (CRS) has been deferred. The original implementation date for CRS had been set for 1 January 2016.

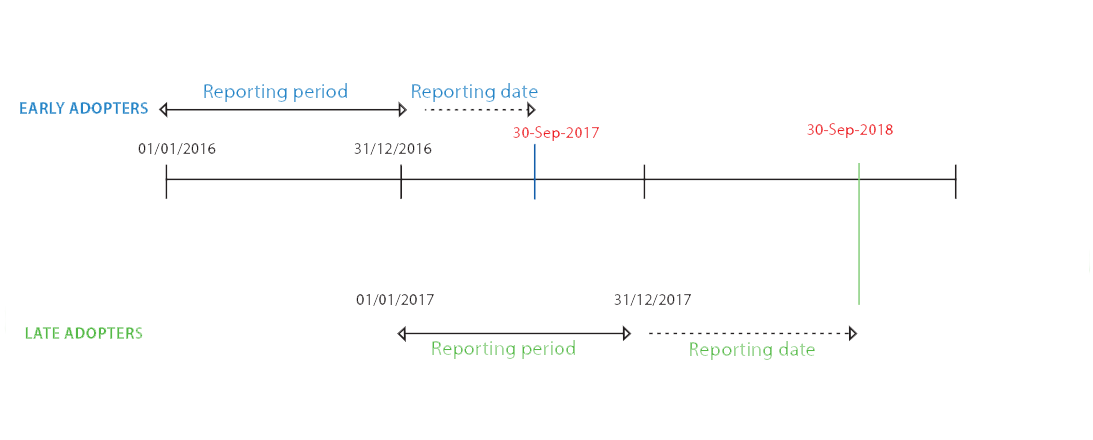

CRS timeline